Risk/Reward Risk/Reward

August 2013

AVENUE MAGAZINE

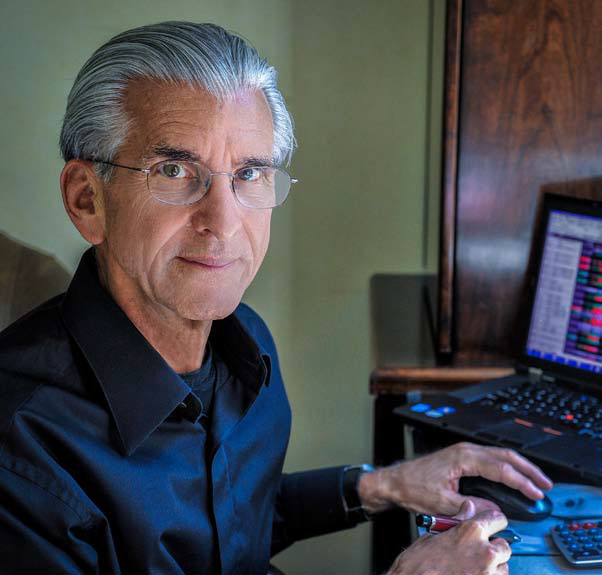

Meet Robert A. Kanter, a highly successful trader, risk manager and the principal of Wainscott Advisors

What is unique about your firm and what distinguishes you from

others in your field?

Wainscott Advisors is a one-man firm, except for computer and clerical

staff. All advice is individualized, explained on a one-to-one basis and

paid for by the hour.

What experience do you bring to the table?

I have over 50 years of trading and risk management experience

as an on-floor specialist broker in securities [L.W. Herman and Co.],

managing partner of a stock and options trading firm [ARBCO],

president of a specialist firm [Kanter, Blau and Woods] and the founder,

CEO and risk manager of ETG [Electronic Trading Group], a brokerdealer

with over 300 customers and traders.

What is your investment philosophy?

First, determine your risk tolerance and reward objectives within the

framework of your financial circumstances. Second, make a judgment

call as to the direction of the markets you plan to invest in, with

consideration of world economic conditions as they presently exist,

and how they may exist in the future. Third, research the available

vehicles in which to participate. Last, construct a portfolio and

analyze it with respect to liquidity, volatility and, in each respect, how

a particular position might fare in the portfolio as a whole.

Can you share anything newsworthy about yourself professionally?

I was the subject of a Barron’s feature article. I was the founder and

initial president of the Chicago Board of Options Exchange Market

Maker Association and was on the Exchange’s board of directors and

executive committee, which affected the first legislation against front

running. In 1987 I was asked by Senator William Proxmire’s Senate

Banking Committee to head a hearing on market manipulation.

Professionally, however, I am most proud of the fact that I have never

had a losing year.

What are people asking for these days?

People want and need higher yields—however, they make the mistake

of not analyzing other factors such as liquidity, interest rates and the

credit risk of those higher yields. I must continually explain the concept

of total return. Most investors are more interested in dividend yield

or their rate of interest, without proper assessment of potential

appreciation or depreciation of the instrument. Unrealized profit

or loss, combined with dividends or interest, determines the total

return—which is what matters most.

What are the most important things one should consider when

contemplating any investment?

Within the context of one’s entire portfolio, what is your expectation

of gain versus loss and the probability thereof? When you factor the

expected gain by the probability of that gain, the result should be at

least one-and-one-half times the amount you are willing to lose.

In the current economy, what’s the best advice you can give

your clients?

Be careful not to be in “crowded rooms,” i.e., being in an asset class

that everyone else is in and believing that you can get out the door

first in the event of fire.

What is the most exciting part of your job?

The most exciting part of my job is knowing when to liquidate a

profitable position, and protecting a client from an unnecessary and/

or substantial loss.

If you were not an investment advisor, what would you be?

And why?

A jazz pianist. On my 60th birthday I gave a private concert at

Weill Recital Hall. Discovering a great chord is as satisfying as a

good trade.

Exerpts from AVENUE MAGAZINE

120 | AVENUE ON THE BEACH • AUGUST 2013

Click here for the original PDF version of this article.

Click here for list of all news articles.

|